Dental insurance companies: Bewilderness to Clarity: 2

- Kathan Mehta

- Aug 30, 2025

- 3 min read

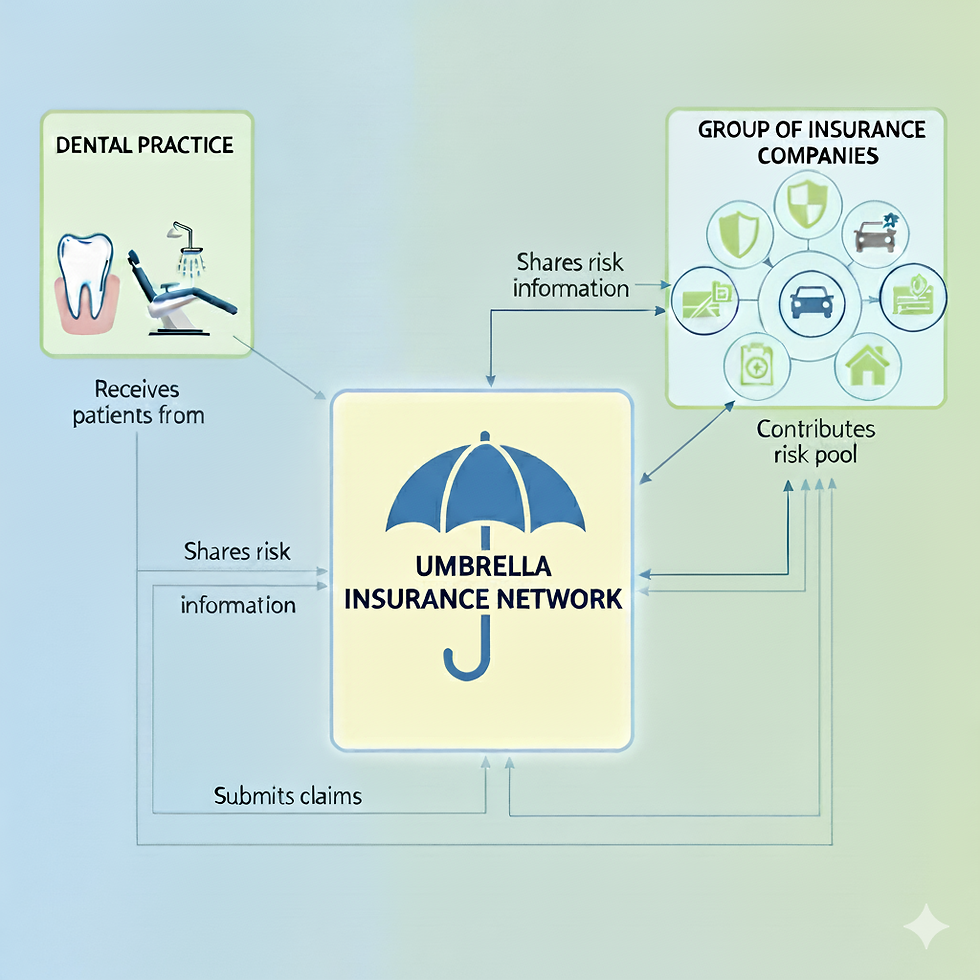

In the previous article, we realized how much healthcare firms are bleeding money and how some streamlining exercises can help protect revenue at various levels. We even saw how utilizing the correct umbrella networks can help increase revenue and, at the same time, in this PPO-driven market, you get the freedom from not relying yourself on Medicaid mix. According to one study by ADA, almost 50-60% of total dental visits were from PPO Insurance and only 20-30% were Medicaid and Chip patients overall across the nation. To summarize, there are certain benefits which can help strengthen the insurance coverage at your dental practice:

1) Hassle-free credentialing for providers. Credentialing with one company will put you in-network with the same reimbursement rates with multiple insurances.

2) Higher reimbursement rates as compared to when provider gets directly contracted with the insurance.

3) Saves time and resources.

4) Capture larger patient base and remove dependency from Medicaid patients.

Now, most of the dental insurances have an annual maximum of a little $2000, yet more than 80% adult population prefers to have a dental insurance and most importantly more than 70% of them did visit dentist during 2022 (which witnessed record-breaking dental services utilization compared to previous years). According to a recent study by NADP, approximately 293 million Americans (80% of total population) have dental coverage. Even if we consider a humble CPV (care per visit) to $300, total dental industry can be worth 87.9 billion dollars which excludes Cash patients/ private pay patients.

As we approach to maximize the reimbursement rates, or simply improve CPV by seeing the same number of patients– which is going to benefit the dental owner/ rather company nowadays by saving both money as well as overhead costs. In the previous article we witnessed how comparing different insurance companies and drive decision making process before starting an affiliation. Once the networks affiliations are selected, it’s very important to make sure that individual insurance companies do acknowledge your affiliation promptly so you can be start receiving reimbursements. At this stage establishing clear communication channels at various levels within your organization is the most important step. Any team member within your organization – it can be your front desk team member, claims-follow-up personnel, office manager and of course any other support team member who might need to communicate with insurance. There is a very simple way to do this-

- Prepare a clear list of insurance companies and desired network affiliation

- Establish one point of contact with both insurance company and Network affiliation (Vendor relationships critical here)

- As soon as recruiting is completed, be on top of insurance companies to update their records. Usually leased-network wont provider you with a three way contact with both the companies)

- Never hesitate to appeal for claims if they are not processed with correct negotiated rates. This can be challenging sometimes with certain insurance companies.

- Last but MOST important, instead of relying on Claim payments- Network status must be verified while doing Insurance Verification before the patient’s appointment.

To conclude, I will leave with a contrasting comment. I started the article with the goal of simplifying things yet when you look at the process-flow perspective, the whole umbrella network deal is adding more complexity and layers to the process. You will need to be up to date with the latest policy changes that insurance companies make. They always decide to opt-in and out of these group networks for their own business benefits and be prompt enough to navigate the change while being risk averse. Will you still be interested in taking up these Network Affiliations!!!

May be comparing the risks against opportunities might help....

Comments